It may not seem obvious, but a clean home can save a lot of money. Clutter can result in broken or lost items, and a messy home will always depress you- leading to a weakening of resolve to save money. This is nowhere more obvious than in the kitchen. You will be a lot more inclined to cook at home (and thus save money) if your kitchen is clean. Remember when cooking to keep a sink full of warm water to make clean up a breeze. If you can keep it clean, it will be much easier to…

You don’t have to go out to have a good time, especially if going out involves a bar or a club. It is lovely to go out from time to time, but it can mean hundreds a month in unnecessary expenses if you do it too often. Having friends over will be much cheaper than meeting friends at a bar, and will be more relaxed as well. If you do go out, take a set amount of cash and leave the cards home. This will stop you from over spending if (and when) your judgment becomes impaired.

This was a popular adage in the Great Depression, but has fallen out of fashion these days. Our waistlines would be smaller and our wallets fatter if we could all remember to only eat what we need to satisfy our hunger. There is nothing wrong with leftovers, and stretching a meal into two or three has serious financial advantages. This lesson is also important where children are concerned. Remember that children often eat much less than adults do. Only give a child a small portion of food. If they need more, they can have more, but there is no excuse for tossing out half eaten sandwiches or dishes with only a bite or two missing. Keeping a close eye on what goes on the plate and what is left behind will save a great deal of money.

Know what you have in your fridge, freezer and pantry (as well as throughout the rest of the house). This will prevent the purchase of doubles, and will help you use what you have before it gets a chance to go bad. There is no excuse for throwing away food! If it has gone bad, let it be a lesson to you to keep a closer eye on your supplies.

Take advantage of deals, especially where meat is concerned. There is nothing wrong with freezing a meal. You can purchase bulk packages of different meats and freeze in individual portions. Similarly, when cooking you can make extra to freeze. This works exceptionally well for soups. You can freeze soup conveniently by ladling into freezer bags and stacking. When they are needed later, all you need to do is add a little stock or water and heat up on the stove. In this way, you can keep your home stocked with weeks or even months of food, getting into the habit of only buying food on sale and saving incredible amounts of money.

Don’t go crazy for holidays or birthdays. Remember that it is the event you are celebrating, not the expense. Certainly it is ok to spend money on a holiday or birthday, but keep it within the importance of the event. A three year old’s birthday, for instance, doesn’t need a rented pony or a three tier cake. Christmas doesn’t require an expensive gift for absolutely every acquaintance, nor do the people you are buying for require triple digit present prices.

Trading with friends and neighbors just makes sense. Their old items can still be new to you and vice versa. Similarly, items you only use once in a blue moon can be shared among neighbors, from ice cream makers to pruning shears, saving everybody plenty.

It’s not just for kids anymore: Giving everyone in the house an allowance will prevent unplanned spending from the main budget. It will also seem easier to save up for something when you are working from a solid amount in your allowance instead of what’s left over in your paycheck.

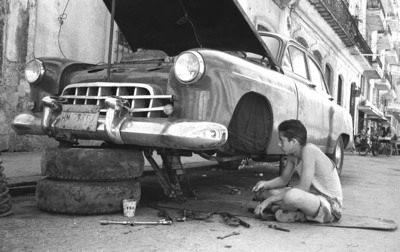

Always have physical and dental checkups, and practice routine maintenance on your car and home. Preventative care is always many times cheaper than a repair. In addition, everyone should know how to fix minor things in their home and car.

Many homemade things are not only less expensive than their store bought counterparts, but taste or look better, too. Where food is concerned, the more from scratch it is, the better and cheaper it tends to be. Bread is an excellent example of this rule. If you could have tastier, fresher bread for a fraction of the price of store bought, why wouldn’t you? Another excellent home made item (depending on the laws in your state/country) is beer. Where I live, the initial investment to brew about 100 bottles of beer is $100, or a $1 a bottle. After you have the equipment, it is $30 for 100 bottles, or $0.30 a bottle. Not a bad price for the best beer in town.

Even the most frugal among us may have our resolve weakened by the glassy eyes and pouting lips of our children. Don’t give in! Of course your children can have toys and books and games and, on occasion, candy. The problem is, you will walk past about 300 of these kinds of items with your children every day. Remember that these things are meant to be special, they should never be an obligation. Few children truly benefit from getting everything they ask for.

Specialty items are luxury items. Few homes truly need a juicer, or an apple corer, or an ice cream maker. Make sure, when purchasing items for the home, that it is not only necessary, but that it is capable of performing a variety of tasks. An immersion blender, for instance, is cheaper than a regular blender and more versatile. A couple quality knives can do the work of dozens of specialty knives.

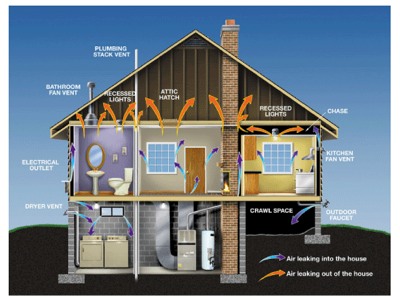

Keep your thermostat cooler in the winter and warmer in the summer. If you get slightly chilly in your home, put on a pair of socks or cuddle up in a blanket before you fire up the furnace. If it’s too warm, make sure your home wouldn’t be easier cooled with an open window. Speaking of windows, keep them well insulated, by having them properly sealed and using blinds and drapes that will keep out the cold and keep in the warm. On hot days, keep the blinds shut on windows facing the sun. In addition, always remember to only use lights or other power items when you actually need them.

Every debt, as soon as it is incurred, especially if you are struggling to make ends meet. Bills are bad enough without late charges and interest piling up. Putting off a bill is never a good idea.

It may seem obvious, but then the current financial climate seems to prove this common sense is not so common. There are a few items in life you will likely need to get a loan for (a home, for instance), but everything else is meant to be bought outright. While it is actually a good idea to have a credit card (to help build credit), it becomes pointless if you can’t pay off the balance every month. If you find yourself struggling to maintain a credit card, get rid of it. They are too easy to get in over your head with. Owning everything outright is much cheaper and much less stressful, besides being beyond the realm of repossession should you hit exceptionally hard financial times.